The French startup ecosystem continues to create jobs, with 4% growth in the first half of 2024. While hiring remains strong (+17%), a rise in layoffs in June calls for

A major announcement was made recently to support the innovation ecosystem.

In particular, the aim was to be as competitive as the EIS tax system, which works very well in the UK.

The Enterprise investment scheme (EIS), and its associated incentives such as SEIS, VCT and SITR, are not individual tax reliefs. They are a package of tax benefits for venture capital investors.

These benefits include direct income tax reductions, capital gains relief and tax exemptions in certain cases of loss, which is likely to be the case with EIS-qualified companies due to their high-risk nature.

To remain eligible for EIS, shares must be held for at least 3 years from the date of purchase.

This scheme raises €2 billion each year and creates 25,000 jobs.

The government would like to build on this, and the following points were presented by

In France today, the structural context points to strong growth in the start-up ecosystem. Every month, GOWeeZ brings you the latest deals raised. #followus

However, we can see that fundraising is lower than in the UK.

This is reflected in 2 symptoms:

To remedy this, a mission was launched, resulting in some thirty measures to support investment in start-ups and innovative SMEs.

Here are a few points from the report’s flagship measure on support for start-ups, the “young business measure”.

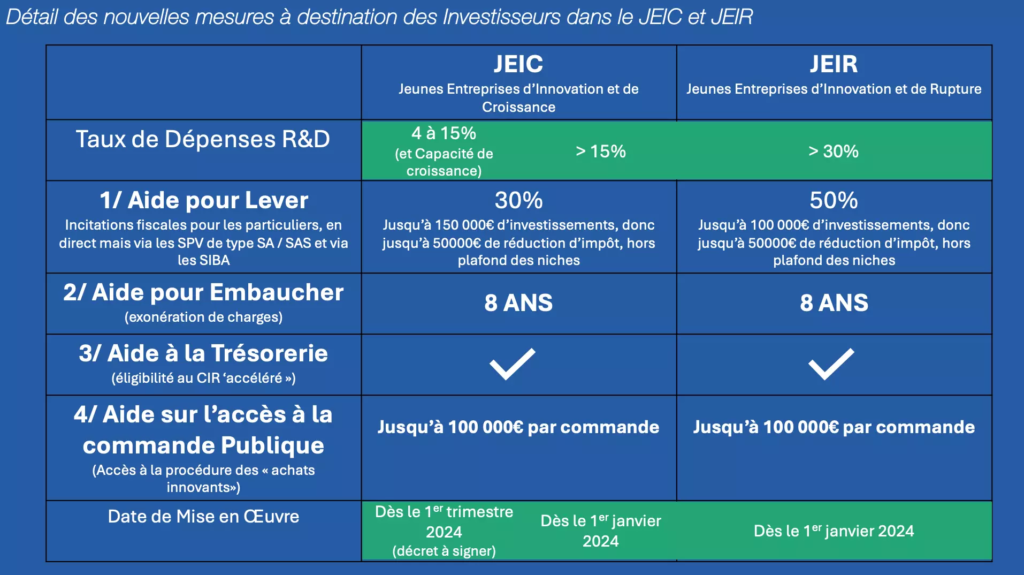

This measure aims to support start-ups through four levers:

Greater emphasis has been placed on the first point, where two categories of young innovative company (JEI) have been defined: :

In addition, tax incentives, such as tax reductions of 30% for JEICs and 50% for JEIRs, are available to investors.

Even if ceilings are logically established, an additional €50,000 tax reduction is available (outside the ceilings for tax niches).

This measure has been in force since 1 January. The good news is that this did not require any approval from the European Union or any decrees.

However, some of the details still depend on forthcoming decrees, but the impact of this measure is already underway for certain categories of start-up companies.

Thanks to these new benefits, the aim is to achieve half a billion euros of investment by 2024.

Stimulate a positive dynamic in the scheme, opening up the promise of capital for young innovative companies.

In addition, this initiative aims to create between 30,000 and 50,000 jobs, in line with major political objectives, including full employment by 2027.

Start-ups focusing on disruptive technologies are often linked to academic research.

The standard model in physics is an example of a technology that can generate unexpected innovations through serendipity.

The importance of these technologies in complementing SaaS projects and marketplaces, which are insufficient to solve the challenges of the energy transition.

The structure mentioned above is strongly focused on disruptive technologies.

For example, it supports projects linked to decarbonisation.

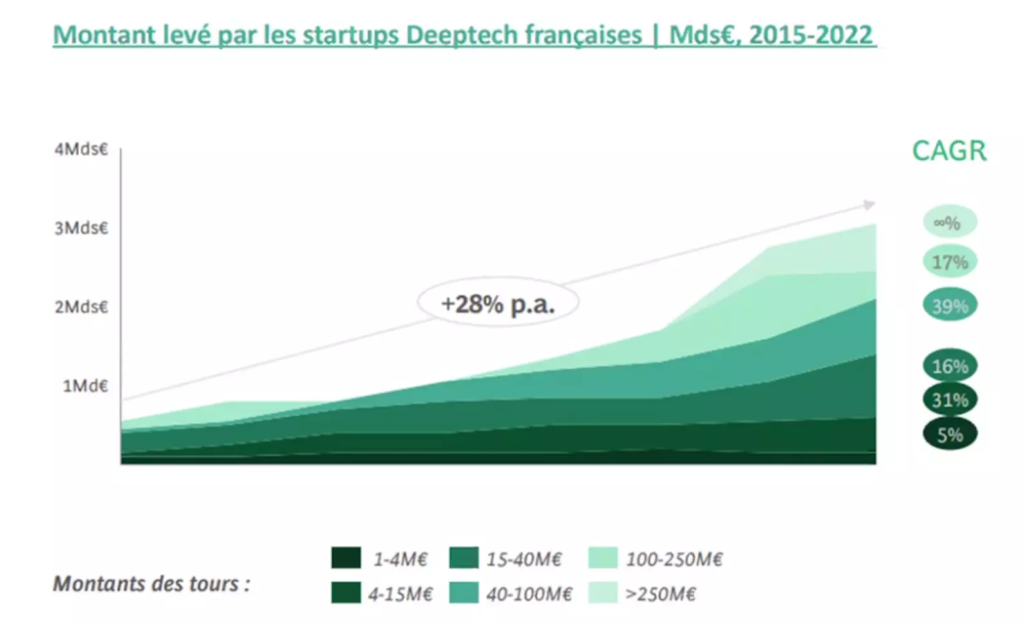

The financing of start-ups, particularly those in the Deep Tech category, is emphasised.

In 2023, nearly €2.5 billion was raised, with growing interest from investors.

Sectors such as AI, healthcare and quantum are seeing significant activity.

Deeptech now accounts for almost 28% of fundraising in France.

Emblematic companies such as Mistral AI are standard-bearers.

The financing trajectory of Deep Techs shows steady growth, but nevertheless raises refinancing challenges.

It is estimated that around €12 billion will be needed over the next three years (2024-2026), according to data from France Deeptech.

According to the IEIC, France Angels, Essec barometer, the expected fundraising for 2023 is €1.4 billion for AI (Artificial Intelligence). 700 million for Health and 250 millions € for Quantum.

As you can see, it is important to mobilise funding to support breakthrough innovations.

Although there is an estimated capacity of around €2 billion from funds specialising in technologies, a financial gap of around €10 billion is forecast between 2024 and 2026.

The challenge is therefore to mobilise private funding, involving corporate investors as well as private savings.

Tax incentives, such as tax credits, are seen as an attractive way of supporting private investment.

With more than 4,000 companies already in the pool of so-called “financeable” companies.

Today in France, there are a significant number of companies eligible for financing,

Back to GOWeeZ news

Pour nous suivre :

Linkedin START-UP GOLF CHALLENGE

Fondateur de GOWeeZ et de MY PITCH IS GOOD

The new measures recently introduced at the start of 2024 encourage investment in innovation, subject to conditions (5 years of patience for the investor before a ROE) Investment in JEIC and JEIR. Measures to support start-ups in four areas. Finance, Human Resources, Public Procurement and Research and Development.

Fabrice Clément Tweet

Goweez © 2025