The French startup ecosystem continues to create jobs, with 4% growth in the first half of 2024. While hiring remains strong (+17%), a rise in layoffs in June calls for

At GOWeeZ, we have been monitoring monthly fluctuations in investment volumes for many years.

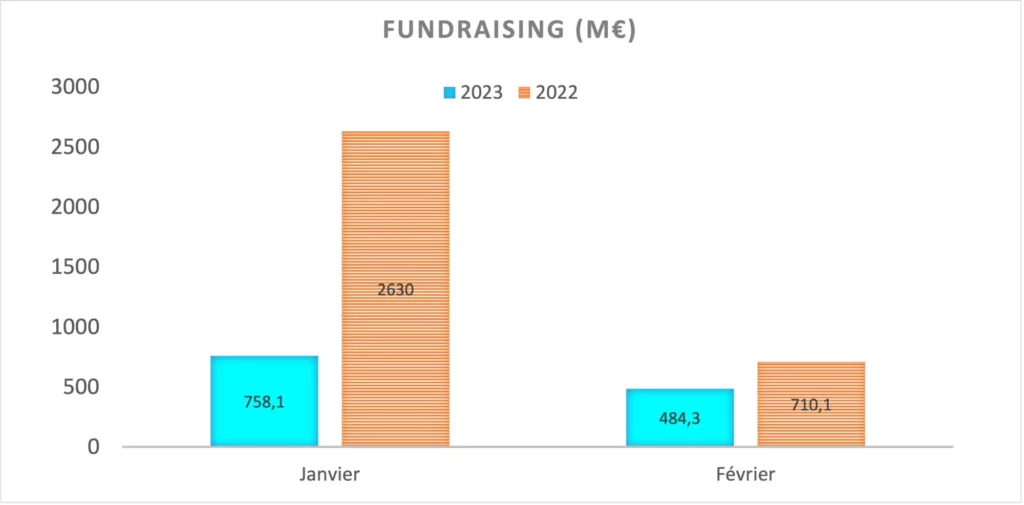

Although February 2023 showed an investment volume twice as high as 2021, it is down by 47% compared to 2022.

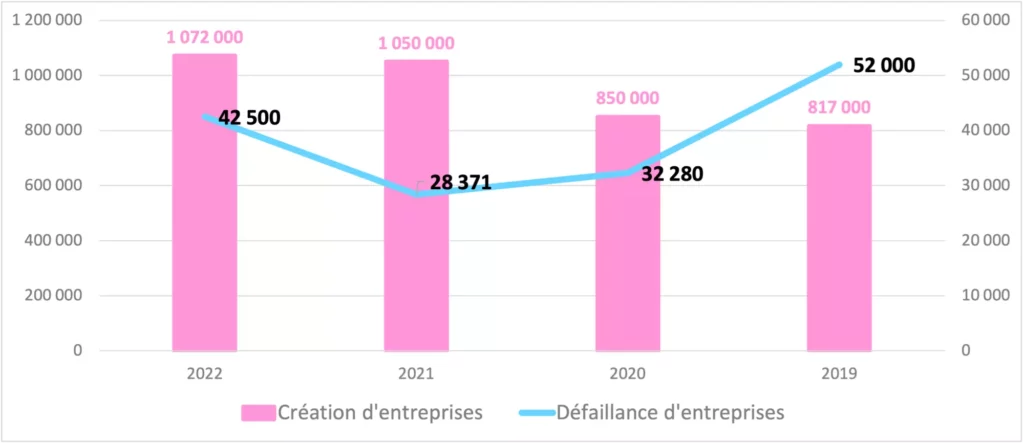

While the number of new business creations continues to grow, with 996,000 in 2021, representing a 17% increase compared to 2020.

In 2022, a new record was set with 1.072 million new businesses created (source: INSEE). However, it’s important to note that 61% of these are self-employed or sole proprietors.

The sad news is that the number of businesses going bankrupt has also reached a record high. This number has increased from 28,371 in 2021 to 42,500 in 2022. In 2020, there were 32,000 business failures. Unfortunately, the manufacturing sector has been the hardest hit.

In response, the BPI (French Public Investment Bank) initiated a plan to revive industrialization in France for 2023.

A first report highlights the relationship between startups and industrial SMEs, seen as growth drivers for the French industry.

Indeed, the BPI has identified 1,900 industrial startups across the country in this report, including 44% in DeepTech and 38% in GreenTech.

At constant scope, 2023 is far from starting off like 2022. Where over 3.3 billion had been raised during the first two months. This figure was also driven by four significant funding rounds, with Qonto and BackMarket raising 486 million and 420 million respectively in January 2022.

PayFit and Exotec also contributed to the 2022 funding landscape by raising 254 million and 290 million respectively.

While there has been a significant decline in total funding raised in 2023 to date, totaling 1.2 billion euros, it is important not to be overly pessimistic.

The current uncertainty is certainly a factor to consider in this analysis.

However, the overall momentum remains positive, and aside from 2022, the funding levels for the past six years have never been reached before.

Investment in companies remains an attractive value to consider.

Valuations have become more reasonable. While investors are increasingly concerned about the quality of the management team and their ability to navigate uncertain conditions and drive their projects forward.

Of course, this is not the only criterion, as market traction, growth, and projections are also important elements to consider.

Note: If you’re looking to raise funds, MY PITCH IS GOOD ! can help you gain visibility among the GOWeeZ investor community.

–> Back to News

Goweez © 2025