In 2026, as deepfakes deceive 78% of facial recognition systems, a French startup based at Station F is proposing a radical alternative: neural signature authentication. Yneuro has developed Neuro ID®,

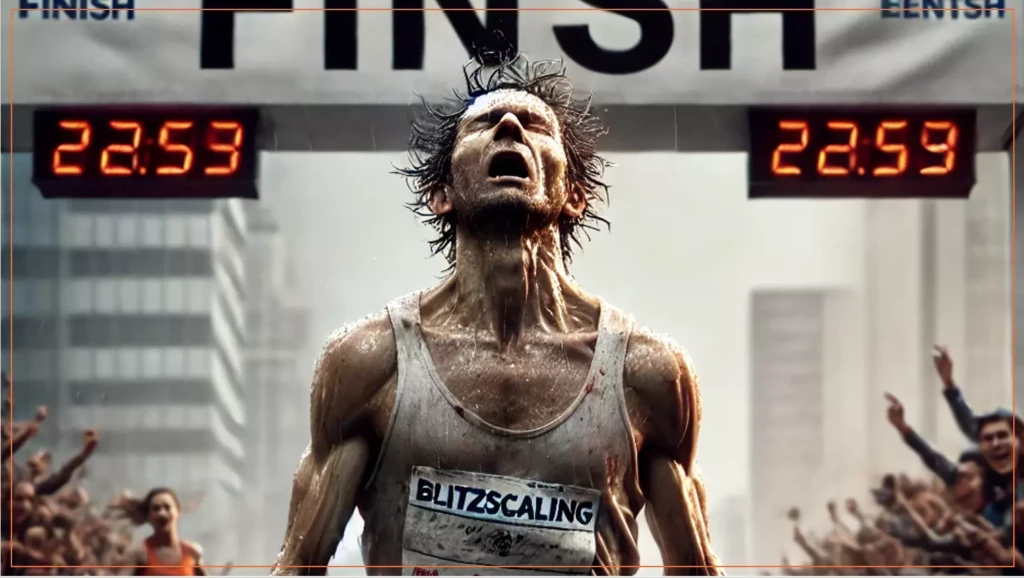

Talking about blitzscaling means stepping straight into the beating heart of modern technological capitalism. It is a fascinating strategy, often admired, sometimes criticized, and increasingly questioned as its financial, human, and industrial costs become more visible. Long presented as the ultimate path to startup success, blitzscaling now deserves a more lucid, more economic, and less ideological reading.

Blitzscaling is a growth strategy that consists of prioritizing speed of expansion over efficiency and short‑term profitability. The company deliberately accepts massive losses, imperfect organizations, and sub‑optimal decisions in order to capture a market before competitors do.

The logic is simple: in certain markets — platforms, networks, global software — the winner takes almost all. Being first, or growing faster than everyone else, creates network effects, locks in demand, and makes late entry prohibitively expensive.

Blitzscaling is inseparable from three structural conditions:

Abundant capital: Silicon Valley long benefited from near‑unlimited access to venture capital.

Instantly global markets: digital products scale without borders.

A risk‑embracing culture: failure is seen as learning, not as a fault.

In this environment, burning cash is not a problem in itself. The burn rate becomes a strategic tool, planned and negotiated. The objective is not to be profitable quickly, but to be dominant at exit — IPO or acquisition — usually within five to seven years.

Early emblematic cases shaped the myth:

E‑commerce platforms sacrificing margins for years to crush competition.

Global marketplaces massively subsidizing supply and demand.

Mobility and delivery players losing money on every transaction while gaining market share.

These companies demonstrated that it was possible to become extremely wealthy while burning money, as long as valuations increased at every funding round. New investors paid higher entry prices, effectively financing past losses — a perfectly rationalized system… as long as the music keeps playing.

Speed allows companies to outpace competitors decisively. In network‑effect markets, a few months’ delay can be fatal.

Rapid growth tells a story investors love: ambition, dominance, leadership. Well‑executed blitzscaling enables startups to raise extraordinary amounts of capital, often far beyond economic fundamentals.

Once critical mass is reached, the cost of entry for new players becomes prohibitive. Markets concentrate around two or three giants, who can then — in theory — begin monetizing.

Blitzscaling only exists as long as capital remains available. If the tap closes, the model collapses. Structurally unprofitable companies have no safety net.

Burning cash for years while betting on hypothetical future profitability can lead to absurd situations: companies that are widely used, highly visible… yet economically fragile.

Growing too fast often means sacrificing culture, processes, and managerial quality. Teams chase targets, mistakes accumulate, and organizational debt explodes.

The case of OpenAI and Sam Altman crystallizes today’s tensions around blitzscaling in the age of artificial intelligence.

On paper, the numbers are impressive: around 300 million users worldwide, global brand recognition, and an unmatched ability to raise capital. Losing $14 billion is not an immediate issue as long as $40 billion can be raised — and potentially another $40 billion tomorrow. Losses are secondary. The real issue lies elsewhere.

Because 300 million users is nothing at global platform scale. True global successes — in music, video, social networks — are measured in billions: one billion, two billion, three billion users.

OpenAI is structurally incapable of reaching such scale.

The problem is not marketing. It is physical and industrial.

Today, OpenAI is already unable to provide a consistently high‑quality premium service to more than a few hundred million people — not because of lack of demand, but because of capacity constraints:

insufficient energy,

insufficient water for cooling,

insufficient data centers,

insufficient control over infrastructure.

Offering a $20–30 monthly subscription to two billion people is simply impossible under current global conditions. The bottleneck is not software; it is reality.

Another major constraint is market access.

OpenAI will not freely enter China. India will not grant unrestricted access. Africa — over one billion people — remains largely out of reach due to infrastructure, purchasing power, and digital sovereignty.

As a result, OpenAI’s economic model must rely mainly on:

North America,

Europe,

parts of Asia,

Latin America.

Even with very high penetration rates, the ceiling remains far below that of truly global platforms. Blitzscaling works when the market is infinite. Here, it is structurally bounded.

A fundamental question remains: what does OpenAI actually control?

Not components.

Not data centers.

Not hardware.

Not energy.

Not water.

Value is concentrated in software and models, within a value chain heavily dependent on industrial and geopolitical partners. Burning cash without controlling critical assets means outsourcing strategic risk.

One major factor is widely underestimated: the profound transformation of the internet over the next decade.

Today’s internet is over 30 years old. Its architecture is already outdated. We are moving toward a new phase: the spatial web, immersive 3D, real‑time environments — driven largely by the gaming industry.

Gamers do not want chatbots. They want games, persistent worlds, 3D interaction. This segment already represents around 30% of the global digital market.

Neither today’s internet infrastructure, nor ChatGPT, nor conversational AI models are capable of addressing this demand at scale.

The risk for OpenAI is therefore twofold:

being capped by physical constraints,

investing massively in a technological architecture that may not align with the next generation of the web.

In this context, blitzscaling is no longer merely risky. It becomes a forward flight, unless industrial control and alignment with the future of the internet follow.

The comparison between OpenAI and Google is common — and deeply misleading.

Google built its power on three solid pillars:

massive control of infrastructure (data centers, networks, cables, energy optimization),

early profitability via advertising, which funded expansion,

a nearly universal product, usable by billions at extremely low marginal cost.

Each additional user cost almost nothing, enabling Google to surpass two, then three billion users while generating enormous cash flows.

OpenAI operates in the opposite way:

every additional user significantly increases costs (compute, energy, cooling),

the company does not control critical infrastructure,

the product does not scale universally at low marginal cost.

Where Google benefited from economies of scale, OpenAI suffers from diseconomies of scale.

Google could afford to burn money early because the path to profitability was structural. For OpenAI, the path remains uncertain: the more the product is used, the more expensive it becomes to operate.

This is where the comparison ends.

OpenAI is not the new Google. It is an extraordinarily innovative software company — but one trapped in a fundamentally different physical and economic equation.

Understanding this distinction is essential to analyzing blitzscaling in the age of artificial intelligence.

This approach is distinctly American. It is based on a strong belief:

You do not make money at the beginning. You invest everything to capture the market. Once competitors are eliminated and the market is concentrated, you monetize.

This doctrine is taught, accepted, and historically validated in certain cases. But it is neither universal nor eternal.

In China, for example, this logic is far less accepted. Control of the value chain, industrial integration, and faster paths to profitability are favored. Burning cash without controlling physical assets is seen as weakness, not strength.

For startups, adopting blitzscaling without the necessary resources is extremely dangerous.

Without massive and recurring access to capital, the strategy is suicidal.

Without a huge global market, speed brings no advantage.

Without a durable structural advantage, growth only delays failure.

Many founders confuse fast growth with blitzscaling. The latter requires the ability to survive for a long time without making money, while waiting for a hypothetical future payoff.

Blitzscaling is neither good nor bad in itself. It is a strategic weapon — powerful, but extremely costly and risky. It has created giants. It has also destroyed countless companies.

In a world where capital is becoming more expensive, where infrastructure matters as much as software, and where profitability is again a virtue, blitzscaling is no longer a dogma. It is a choice.

And like any strategic choice, it requires lucidity, real means… and a high tolerance for risk.

The real question is not: can you burn money? But rather: what do you actually control when you do?

Here there is a book to read :

Blitzscaling de Reid Hoffman & Chris Yeh : Although it is a book, it contains startup growth analyses and examples (Amazon, Airbnb) that can be leveraged into charts (e.g. employee growth or revenue growth), inspired by classic blitzscaling case studies.

Advisor et Consultant auprès des dirigeants d'entreprise - Fondateur de GOWeeZ !

Blitzscaling is a growth strategy that prioritizes speed and market capture over profitability, made possible by the abundance of capital in Silicon Valley. While it has enabled the emergence of major technology giants, it relies on massive cash burn and a critical dependence on continued funding.

Fabrice Clément Tweet